In the high-stakes arena of industrial manufacturing, the deployment of an Enterprise Resource Planning (ERP) system is a definitive capital allocation decision. For the C-Suite, the mandate is no longer just operational throughput; it is about validating the Total Cost of Ownership (TCO), optimizing EBITDA margins, and leveraging software assets to secure competitive commercial financing.

This executive dossier dissects the financial mechanics of ERP procurement. We explore the strategic pivot from capital-intensive legacy systems to agile Cloud SaaS models, analyzing how this shift impacts working capital, minimizes cybersecurity liability, and satisfies rigorous audit compliance standards.

Financial Engineering & Asset Management

An enterprise-grade ERP serves as the “single source of truth” for corporate financial planning. It consolidates disparate data streams—Supply Chain, HR, Procurement, and Treasury—into a unified centralized ledger. This integration is non-negotiable for meeting regulatory compliance (SOX, GDPR, ISO 27001), streamlining external audits, and ensuring granular visibility into Cost of Goods Sold (COGS).

Advanced ERP architectures enable real-time standard costing and variance analysis. By automating these financial controls, manufacturers can identify liquidity leaks within the supply chain, thereby improving their credit profile for business loans and reducing the cost of capital.

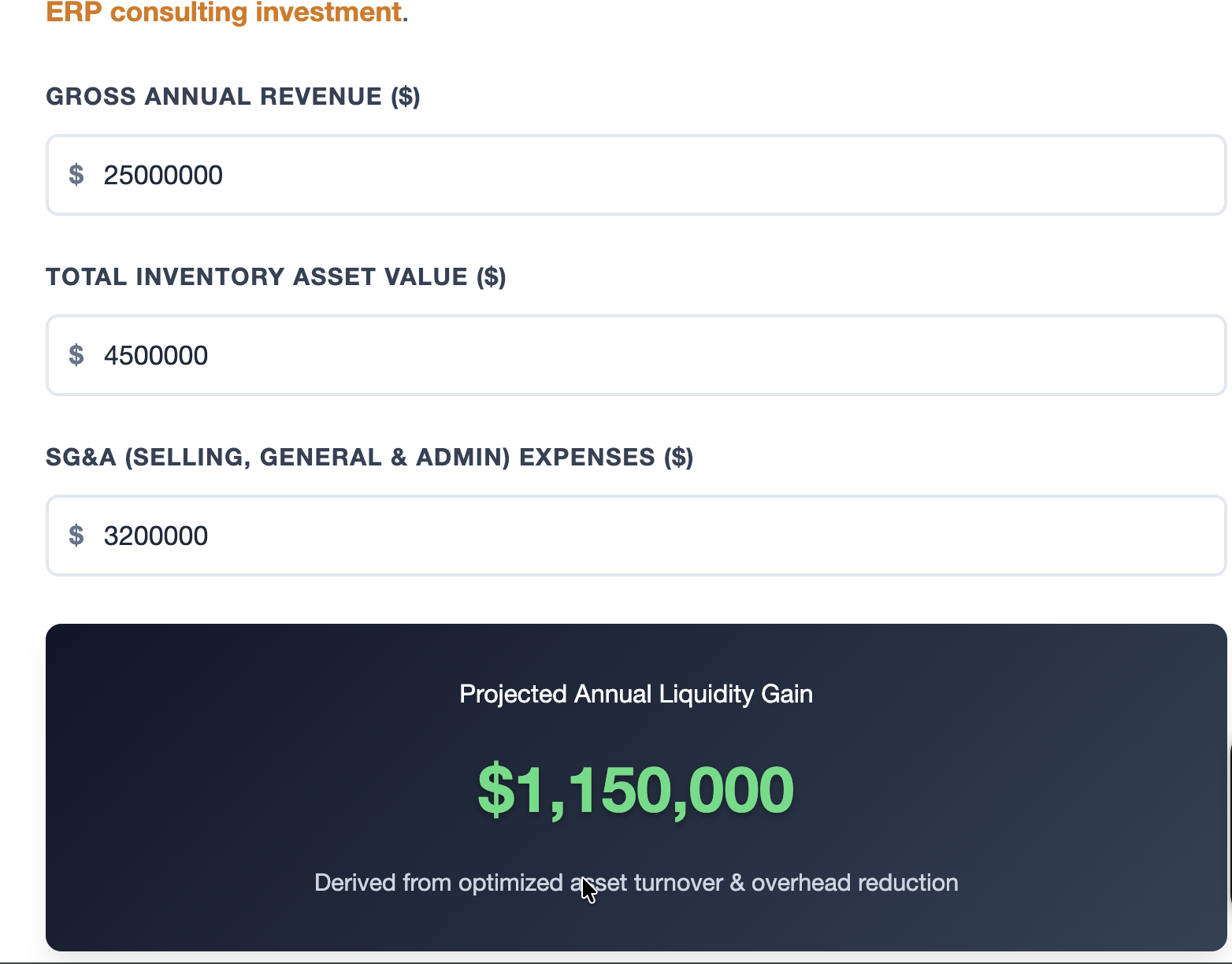

💰 Capital Efficiency & ROI Projector

Input your enterprise metrics to forecast annual free cash flow improvements and validate ERP consulting investment.

*Estimates based on Tier-1 banking benchmarks for digital transformation ROI. Actual SaaS licensing fees and implementation scope will vary.

CapEx vs. OpEx: The Procurement Dilemma

The decision between on-premise infrastructure and cloud solutions is fundamentally a question of balance sheet management. Understanding the nuances of ERP software pricing is vital for long-term fiscal health.

- Legacy On-Premise (CapEx): Requires substantial upfront capital for server hardware, data center cooling, and perpetual licensing. While this offers control, it locks up cash and involves complex depreciation schedules.

- Cloud SaaS (OpEx): The dominant model for agile enterprises. Subscription-based pricing covers hosting, security patches, and disaster recovery. This preserves credit lines for strategic initiatives and simplifies tax treatment as a direct operating expense.

High-Yield Modules for Profit Maximization

To justify the ERP implementation cost, the system must deliver tangible ROI across key profit centers.

- Treasury & Risk Management: Automates cash positioning and ensures compliance with IFRS/GAAP standards. Essential for multinational entities managing currency risk.

- Supply Chain Finance (SCF): Integrates procurement with trade finance platforms, optimizing payment terms and working capital cycles.

- Inventory Optimization (WMS): Utilizes AI to predict demand, reducing capital trapped in safety stock. This directly lowers warehouse insurance premiums and inventory write-downs.

- Human Capital Management (HCM): aligns workforce planning with production forecasts, ensuring labor costs remain within departmental budgets.

Vendor Selection: Tier 1 Comparison

Selecting a partner requires rigorous due diligence regarding Service Level Agreements (SLAs) and scalability.

- SAP S/4HANA: The gold standard for global conglomerates requiring complex intercompany consolidation and tiered supply chains. High initial cost, but unmatched depth.

- Oracle NetSuite: The premier Cloud ERP for mid-market growth. Offers rapid time-to-value and a scalable licensing structure ideal for pre-IPO firms.

- Microsoft Dynamics 365: Leverages the Azure stack for seamless integration with corporate productivity tools (Power BI, Excel), reducing the learning curve and training costs.

ROI & Risk Mitigation: The Business Case

Approval from the Investment Committee hinges on demonstrating risk-adjusted returns. The value proposition extends beyond efficiency into corporate resilience.

Credit Risk & Cash Flow Predictability

Modern ERPs utilize predictive analytics to assess customer creditworthiness and automate collections. This reduces Day Sales Outstanding (DSO) and minimizes bad debt exposure, a key metric for external credit rating agencies.

Case Study: Aerospace Capital Efficiency

Boeing’s Digital Transformation:

By unifying operations on a centralized ERP backbone, Boeing achieved a documented 20% reduction in inventory holding costs. This released millions in free cash flow and improved delivery reliability, directly impacting revenue recognition timelines.

“Investing in intelligent ERP infrastructure is not merely an IT upgrade; it is a strategic hedge against market volatility and a catalyst for sustainable valuation growth.”

Future Trends: ESG & Embedded Finance

The next frontier of manufacturing ERP integrates sustainability reporting and automated finance.

- ESG Compliance: Automated carbon footprint tracking will become essential for accessing green bonds and favorable investment capital.

- Embedded Banking: APIs will allow direct connectivity with banking partners for real-time payments and automated reconciliation.

- Cybersecurity Assurance: Robust ERP security protocols are now a prerequisite for obtaining comprehensive cyber liability insurance.

Conclusion

The transition to a robust ERP ecosystem is a defining moment for enterprise maturity. It converts data into a strategic asset, enabling precise capital allocation. By carefully evaluating financing options, validating Cloud ERP pricing, and prioritizing modules that drive liquidity, organizations secure their competitive advantage in a complex global economy.